NFT Market Paradox: Sales Dip While Buyer Activity Explodes – What’s Happening?

The digital collectibles space presented a curious picture recently, as overall NFT market sales volume saw a slight downturn even amidst a broader crypto market uptick. Weekly sales figures dipped by 4.7%, settling at $95.9 million.

This occurred despite positive movements in major crypto assets. Bitcoin (BTC) revisited the $85,000 mark, while Ethereum (ETH) notched a 2.4% gain over seven days, trading around $1,600. The total capitalization of the global crypto market consequently rose to $2.69 trillion from $2.63 trillion the previous week.

Intriguingly, the decline in sales value contrasted sharply with a massive surge in user engagement. The number of NFT buyers soared by an impressive 96.6% to reach 252,354. Similarly, the count of active sellers jumped by 79.2% to 153,892.

Furthermore, transactional activity within the NFT ecosystem also climbed, with the total number of transactions increasing by 10.4% to 1,569,670 during the observed period. This divergence suggests a broadening user base, potentially engaging with lower-priced assets or a wider variety of blockchain projects.

Ethereum Leads Despite Volume Drop

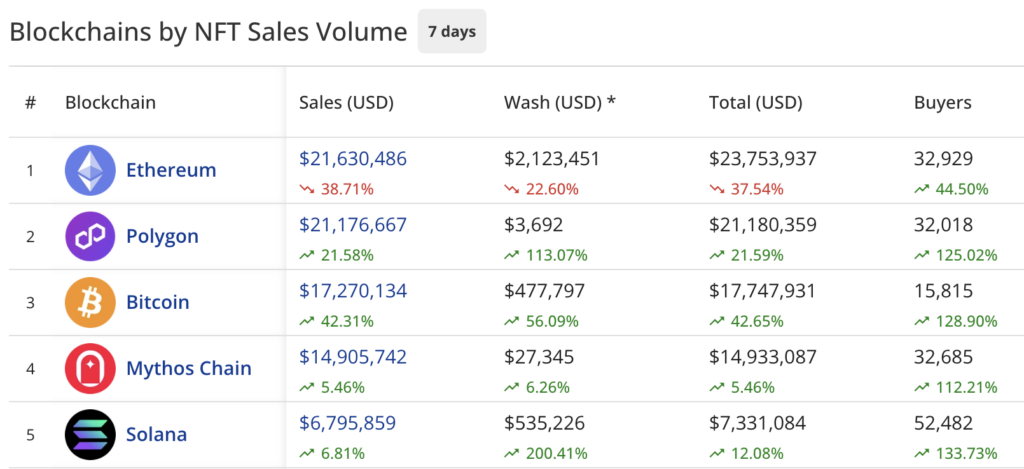

Data from industry aggregators shows the Ethereum blockchain retained its top spot for NFT sales volume. However, its dominance waned slightly, with volume decreasing by 38.7% to $21.6 million. Wash trading activity on Ethereum also saw a reduction, falling by 23% to $2.1 million.

Source: Blockchains by NFT Sales Volume (CryptoSlam)

Source: Blockchains by NFT Sales Volume (CryptoSlam)

Polygon (POL) solidified its second-place ranking, registering $21.1 million in sales—a robust 21.5% increase week-over-week. Bitcoin-based NFTs climbed into third place with $17.2 million in sales, marking a significant 42.2% jump.

MMythos Chain secured the fourth position with $14.9 million in sales volume, showing a modest 5.4% growth. Solana (SOL) completed the top five, generating $6.8 million in sales and recovering 7% from its prior performance.

Reflecting the broader participation trend, buyer counts grew substantially across these leading blockchains. Solana experienced the most dramatic increase at 133.7%, closely followed by Bitcoin at 128.9%, and Polygon at 125%.

CryptoPunks Experience Sharp Decline

In the collection-specific rankings, Polygon-based project Courtyard held onto its leading position with $19.5 million in sales, a 24.6% increase. DMarket followed in second place with $9.7 million, up 8.8%.

Guild of Guardians Heroes ascended to third place with $3.8 million (+3.6%), while Bitcoin’s BRC-20 standard NFTs came in fourth at $3.6 million, surging 42.1%.

A major shift occurred further down the rankings involving CryptoPunks, often considered a benchmark Ethereum collection. Sales for CryptoPunks plummeted by a staggering 80.5%, falling from $9.1 million the previous week to just $1.7 million. This collapse pushed the collection down to sixth place and was accompanied by significant drops in transaction counts (51.2%), buyers (56.6%), and sellers (59.4%).

Despite this collective downturn, high-value CryptoPunk assets continued to command top prices in individual sales. Four of the five highest NFT sales recorded during the period were CryptoPunks. However, the single most expensive sale was SuperRare #10093, fetching 255 ETH (approximately $419,772).

Other notable transactions included:

- CryptoPunks #3873: 165 ETH ($259,514)

- CryptoPunks #1820: 72.69 ETH ($118,299)

- CryptoPunks #1999: 65 ETH ($103,110)

- CryptoPunks #7163: 62.5 ETH ($99,167)

This data highlights the complex dynamics within the NFT market, where overall sales figures don’t always align with user activity or the performance of individual high-profile assets.