Crypto Update: Sui Plummets 14%—Key Risks Behind the Latest ETF Delay and DeFi Hack Fallout

Crypto token Sui is under intense pressure, shedding 14% over the past week as regulatory uncertainty intensifies and lingering risks grip the digital assets market.

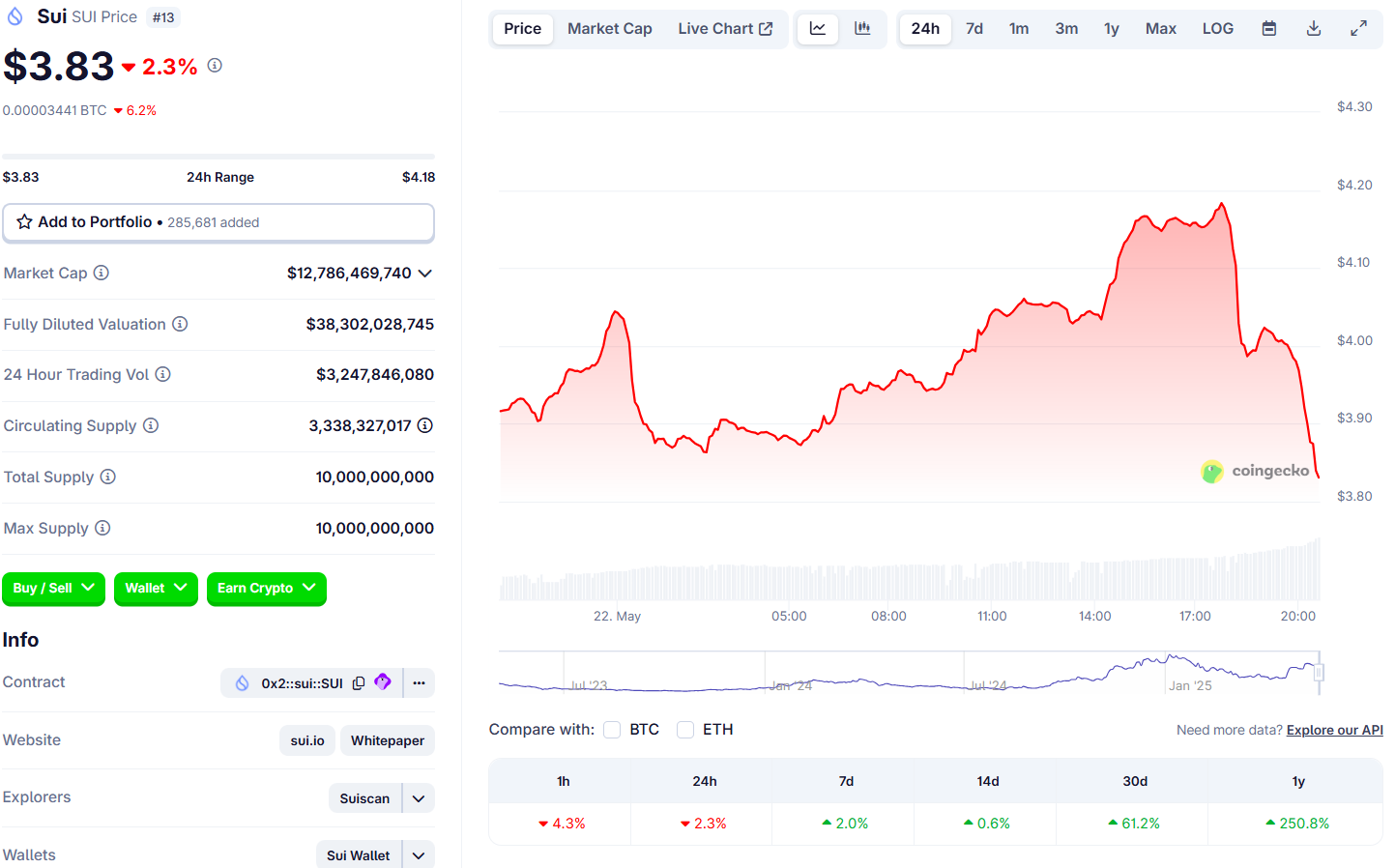

Sui (SUI) dropped another 4% on Thursday, amplifying its recent correction. The bearish momentum stems largely from a wave of negative sentiment following the U.S. Securities and Exchange Commission’s latest move. On June 4, the SEC postponed its much-anticipated decision on a spot SUI ETF backed by Canary Capital. This regulatory decision reignited uncertainty across the Sui blockchain ecosystem, dragging the crypto token near weekly lows around $3.06—a level last witnessed during the sharp May 30 downturn. In that dramatic 24-hour window, Sui plunged 20%, erasing a swift recovery above the $4 mark as intense trading volumes fueled the selloff.

DeFi Security Breach Worsens Market Confidence

Sui’s recent rally hit further trouble amid fallout from the Cetus Protocol hack. On May 22, Cetus—a critical DeFi protocol built atop Sui—suffered a major exploit worth approximately $223 million. According to on-chain analytics, this breach had a ripple effect, fanning doubts about both the safety and structural decentralization of the Sui ecosystem. Cetus powered token swaps and yield farming for over 62,000 active users and generated upwards of $7.1 million in daily trading fees. Yet, Sui network validators responded to the hack by freezing attacker wallets—a move that, although protective, led the crypto community to debate Sui’s claims of decentralization.

Read more: Crypto hack fallout: Sui’s $162M governance vote response

Expert insights highlight that swift reactive governance is increasingly common in Layer 1 blockchain networks under threat, but balancing security and decentralization remains a top challenge.

Macro Weaknesses Shake Altcoins

Additional downward pressure came as the broader crypto market turned risk-averse, with major altcoins such as Solana, Dogecoin, and Cardano suffering double-digit losses in the same timeframe. Analysts point to growing ETF delays, macroeconomic headwinds, and risk-off sentiment as leading factors behind the synchronized correction among altcoins.

For investors seeking better security, exploring the best crypto wallets can help diversify risk exposure and mitigate vulnerabilities exposed by recent hacks.

Discover more: Best crypto wallet solutions for secure DeFi storage

As DeFi protocols shore up their defenses and the market awaits clearer ETF guidance, all eyes remain on Sui’s price action for clues to the next altcoin trend. Crypto observers recommend monitoring blockchain governance proposals and the outcome of regulatory reviews for insight into the evolving Sui narrative.

Explore further: Sui crypto: Boom, memecoins, and network growth

Disclaimer: This article is for informational purposes only and does not constitute investment advice. As with all crypto assets, performance can be volatile and subject to rapid change.