Crypto Rally Surges: Why Market Bulls Bet on Trade Talks and Altcoin Momentum

Crypto markets soared alongside traditional stocks as optimism grew around renewed trade negotiations between global powers. On May 27, the Dow Jones Industrial Average spiked to 42,243 points, echoing bullish sentiment that swept across blockchain assets and altcoins. The surge was fueled by relaxed tariff rhetoric from the White House—an immediate catalyst also reflected in populist DeFi tokens and crypto trading platforms.

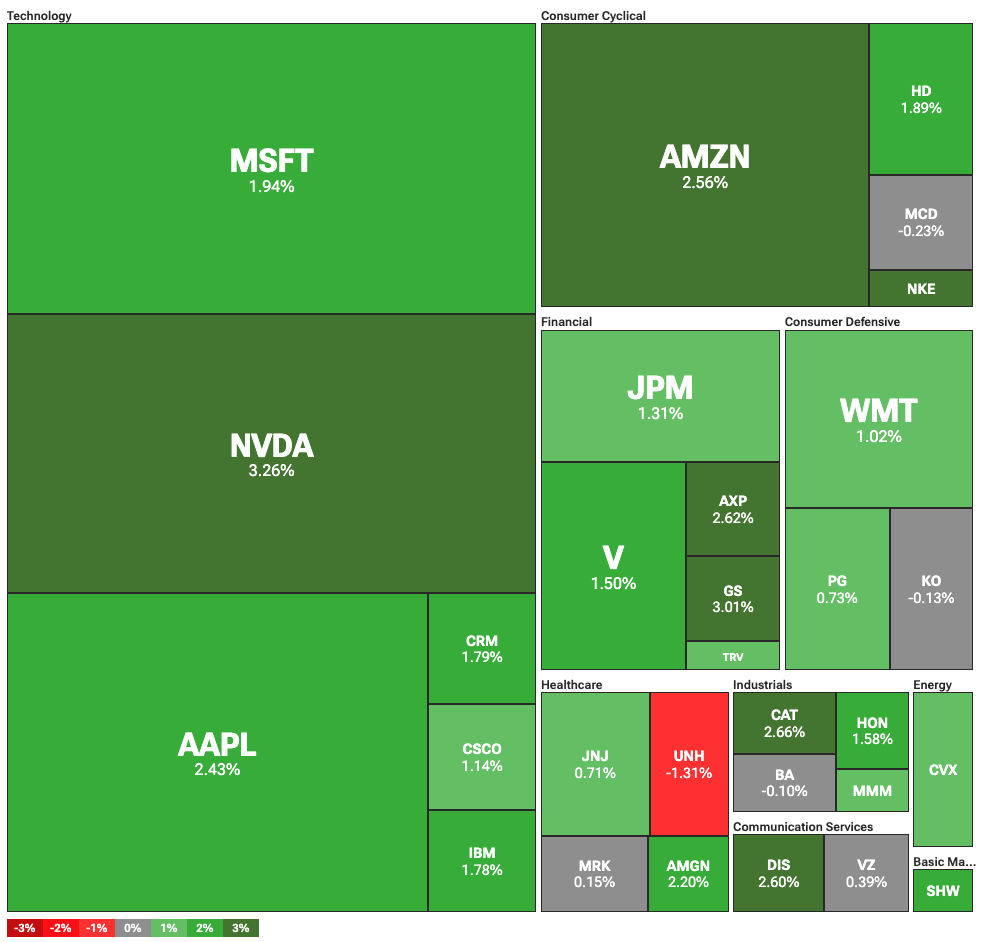

Leading the digital asset charge, top technology stocks such as Nvidia saw a 3.26% rise ahead of its much-anticipated earnings report. Although concerns remain about AI chip export restrictions possibly impacting revenues, investor appetite for innovative tokens and blockchain equities appeared undeterred. Many experts argue that ongoing advancements in AI, like those driving major crypto projects, help underpin both tech stock and token valuations. For a closer look at the potential of next-gen AI-powered blockchain analysis, see our guide to the best AI tools for blockchain analysis.

Apple shares also gained 2.43%, even after fresh threats of a 25% tariff on U.S.-bound smartphones. In a twist, these proposed levies would extend to rival Samsung as well. Such high-stakes policy talk has increasingly spilled into the crypto world, with traders closely watching policy moves for their impact on DeFi protocols, stablecoins, and digital asset exchanges.

Market experts optimistic amid tariff talks

Crypto market analysts point to a unique synergy between global trade policy and digital asset performance. Former President Trump’s softened rhetoric on tariffs and gestures toward swift U.S.-EU negotiations triggered widespread optimism not just on Wall Street but across the decentralized finance (DeFi) space. The European Union’s six-week deadline to resolve mutual tariffs—covering sectors from semiconductors to pharmaceuticals—has added urgency and volatility to the broader investment climate.

“This momentum could accelerate blockchain development and institutional adoption,” noted one digital asset strategist. “Investors increasingly see trade optimism and regulatory clarity as triggers for bullish crypto volatility.”

Negotiators on both sides of the Atlantic are expected to tackle not only tariffs but also key issues like cross-border data compliance—a major concern for crypto projects eyeing mainstream utility. With digital assets positioned at the intersection of finance, technology, and geopolitics, traders are keeping a close watch on shifting policy and its downstream effects on everything from protocol upgrades to altcoin liquidity. To learn more about the intricate relationship between macro policy and crypto price moves, check out our deep dive on how trade news sparks crypto market rallies.

The coming weeks will be critical. If leaders extend the negotiations beyond July 9, markets could see another round of volatility—potentially opening up new entry points for savvy blockchain investors. For those new to digital asset trading, see our comprehensive guide to cryptocurrency trading for beginners.