Crypto Goes Mainstream: Bitcoin and Ethereum Hit Milestones as Wall Street Opens Doors

Crypto is breaking through the boundaries of traditional finance, signaling an era of mainstream adoption for both Bitcoin and Ethereum. This week, the crypto sector caught the spotlight once again as several groundbreaking developments unfolded, confirming the momentum behind decentralized assets and digital currencies.

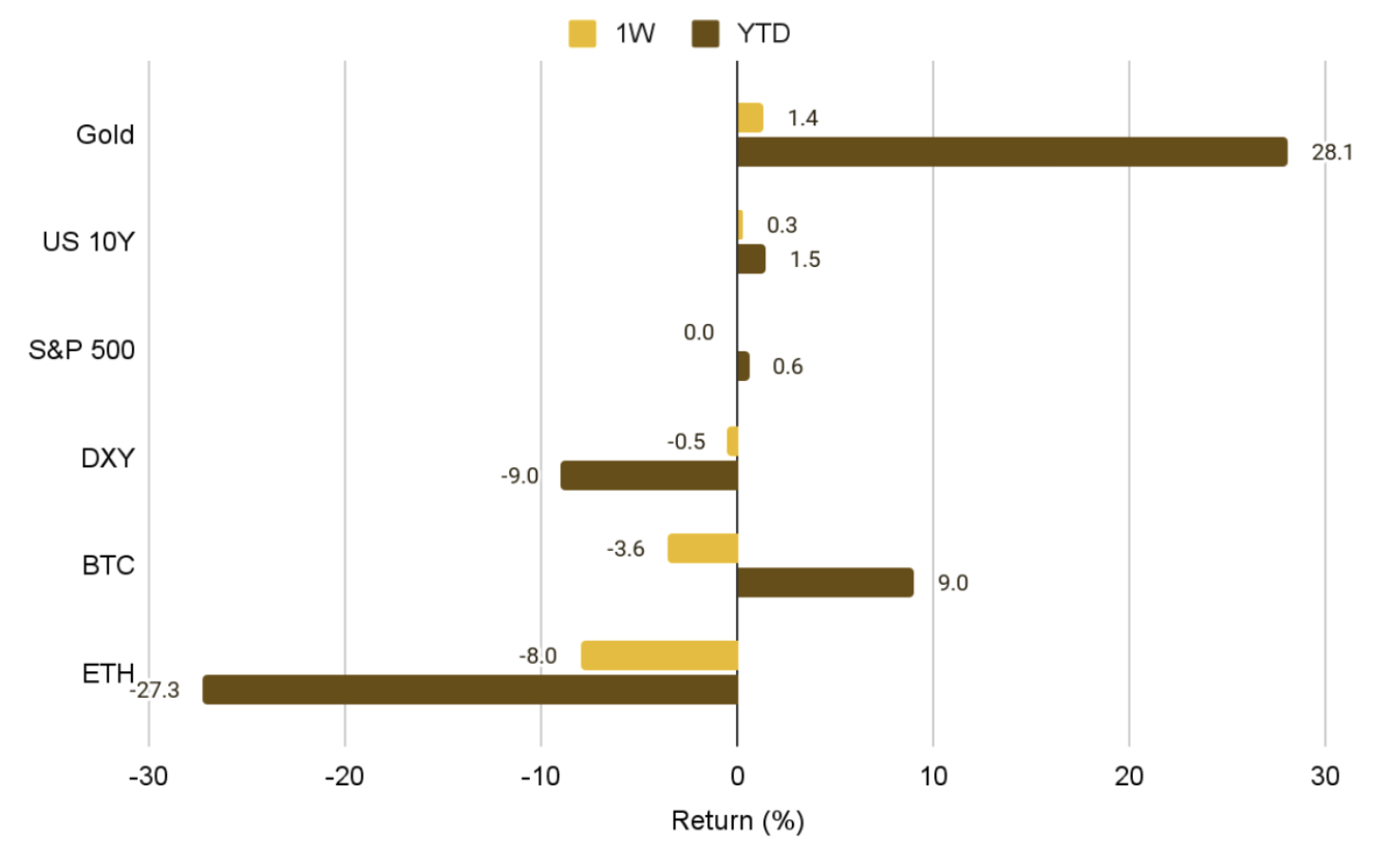

The surge of institutional and regulatory engagement means crypto is no longer a fringe bet—it’s becoming core to the global financial system. However, that journey wasn’t without turbulence. Over the past week, political unrest created headwinds, driving the market into negative territory and making digital assets among the hardest hit. Notably, high-profile conflicts, like the public rift between political and tech leaders, caused uncertainty over the future landscape of blockchain policy and crypto assets in the U.S.

Despite these short-term setbacks, fundamental growth continues. During the week ending June 2, both Bitcoin and Ethereum saw their exchange balances fall sharply. This drop indicates more traders are transferring assets into self-custody or long-term storage, potentially reducing immediate selling pressure and reflecting increasing confidence in the asset class.

Bitcoin reached a weekly low of $101,500, while Ethereum dipped to $2,388. Despite the correction, market analysts point to healthy levels of long-term holding and robust developer activity, especially in the decentralized finance (DeFi) and staking segments, as reasons for optimism. As blockchain infrastructure matures, key indicators signal that both tokens remain well-positioned for future rebounds.

Several pivotal moments fueled the positive outlook. On the institutional side, major U.S. banks are taking big steps: Last week, one of the world’s biggest financial institutions began accepting Bitcoin ETF and Ethereum ETF products as collateral for loans. This move marks a new era of collaboration between Wall Street and crypto, offering greater legitimacy to digital assets and opening doors for high-net-worth investors and corporations who seek exposure without direct purchase.

From a regulatory standpoint, the U.S. Securities and Exchange Commission (SEC) unveiled crucial updates—specifically, new guidance clarifying that staking on proof-of-stake (PoS) blockchains is not considered a securities activity. Experts say this change could launch a new phase of ETF innovation, with products tracking altcoins like Solana and Ethereum poised to gain traction among institutional investors. For an in-depth explanation of how crypto staking works and what the SEC’s decision means for investors, check out this detailed guide on staking in crypto.

The wave of adoption continued in the public markets, too. Circle, the operator behind the popular USDC stablecoin, delivered a blockbuster IPO—its stock soared 120% on debut, highlighting investor confidence in both crypto companies and their role within modern finance. This milestone underscores how blockchain startups are being recognized alongside traditional fintech and banking giants.

This convergence is drawing attention across the industry and beyond. Institutional inflows, regulatory clarity, and public listings all suggest the crypto sector is building a more resilient foundation, even as headlines sometimes signal volatility. For further deep dives on market structure and emerging blockchain investment trends, explore the evolution of crypto wallets and the rising impact of crypto ETFs.

As the path to mainstream finance accelerates, the interplay between digital assets and established financial powerhouses is only set to deepen—a trend closely watched by investors hungry for the next big opportunity in blockchain technology.