Crypto Outlook: Market Braces for Fed Rate Decision as Inflation Eases—What It Means for Digital Assets

Crypto markets were mixed on Monday as investors kept a close eye on the U.S. Federal Reserve’s upcoming meeting—a key moment that could set the tone for digital asset trends in the coming months. As rates take center stage, major U.S. stock indices reflected the uncertainty, with the Dow climbing, while the S&P 500 and Nasdaq dipped. Crypto traders are evaluating how the potential for upcoming Fed rate cuts could reshape the blockchain arena, DeFi opportunities, and altcoin performance.

A leading market strategist suggested the Fed may use this week’s event to lay groundwork for interest rate declines as early as June, with additional cuts possible by year-end. Rising anticipation follows a string of favorable labor and inflation reports, which may encourage more liquidity flows into crypto tokens and staking protocols.

You might also like: [S&P 500’s resilience powers on; could increased institutional inflows boost crypto?]

Inflation Stays Above Target—but Signals a Turnaround for Crypto Prices

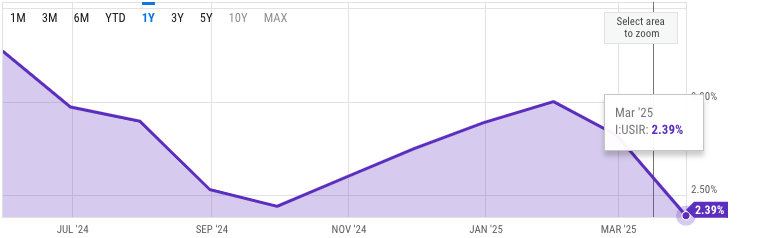

Current U.S. inflation stands around 2.39%—above the Fed’s 2% target—yet it’s now trending downward for a second straight month. The cooling is largely attributed to weaker consumer demand, an effect often mirrored in blockchain’s rapid capital shifts. “A stable macro landscape may provide risk-on opportunities for cryptocurrencies,” commented a veteran economist, noting how these shifts often prompt renewed interest in DeFi and staking yield strategies.

Encouragingly, a recent OPEC+ decision to boost oil production sent shockwaves that led to a sharp but brief dip in oil prices—good news for both inflation and digital asset pricing. Since energy costs typically factor into blockchain mining and digital infrastructure, crypto traders are watching these developments closely for potential positive volatility.

You might also like: [Will tariff hikes push the Fed’s hand and rattle crypto prices?]

On the trade policy front, investor sentiment was jolted by fresh tariff proposals impacting U.S.-based content creators. The move reignited debates about how international trade skirmishes could spill over into crypto and blockchain sectors, possibly affecting altcoin liquidity and NFT exports.

A major blue-chip stock, Berkshire Hathaway, fell notably on Monday following an announcement about a leadership change. While not directly related to crypto, high-profile moves among traditional financiers often signal broader market transitions that digital asset holders should monitor for cross-market impact.

Read more: [How Fed policy could shape Bitcoin’s future amid liquidity changes]

For more insights on how evolving monetary policy could impact your blockchain investments, explore our guides on [the correlation between inflation and crypto portfolios] and [navigating DeFi in shifting markets].