Crypto ETF Resilience: Why Ethereum Funds Keep Gaining as ETH Price Slides

Crypto investors are watching closely as Ethereum ETFs continue to climb, even while the underlying ETH token battles a sharp price slump. Spot Ethereum ETFs have recorded fresh inflows for 14 consecutive days as of June 5, 2024—a performance that outpaces much of the altcoin sector and keeps the spotlight firmly on blockchain investment vehicles.

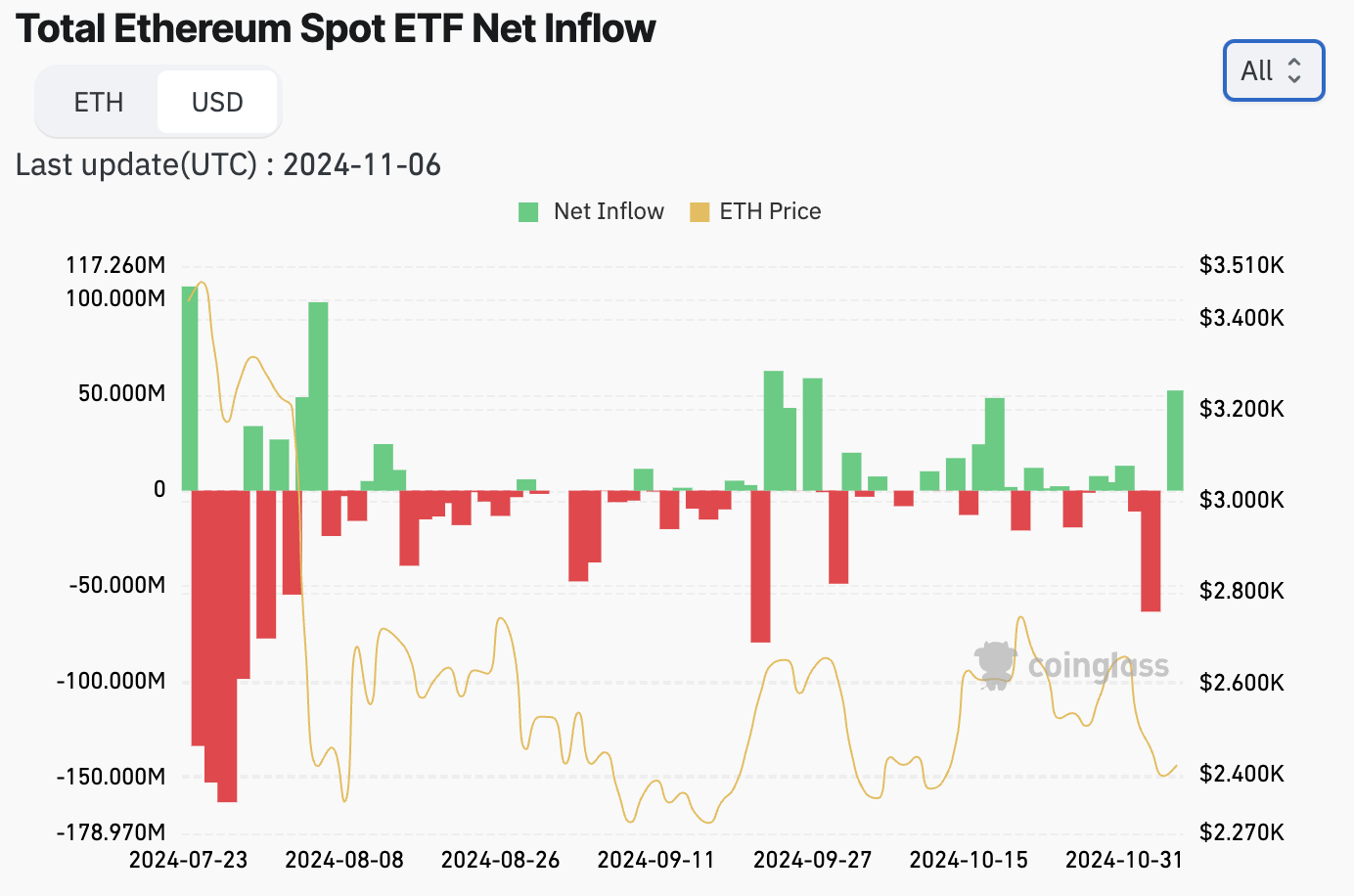

On June 5, inflows into Ethereum ETFs totaled $11.3 million, according to industry data. Although this represents a slowdown compared to earlier in the week, it marks a significant achievement given recent market headwinds. Notably, BlackRock’s ETF absorbed all the positive flows, pulling in $34.7 million, while Fidelity’s core product experienced $23.4 million in outflows. Most other issuers held steady with no major activity.

For context, compare this ETF inflow streak to ETH’s ongoing price woes: the token was trading near $2,478 at the time of writing, down roughly 6% over the past two weeks and sitting 33% below its 2025 high around $3,700 (last seen in January). [You might also like: Vitalik Buterin admits Bitcoin’s dominance in certain areas of crypto]

Despite periodic rallies that briefly lifted spirits in the Ethereum and DeFi communities, the momentum has mostly faded. Many retail investors have shifted to caution as macroeconomic factors and fading confidence drag on price action—underscoring why blockchain-based ETF vehicles are becoming more attractive. For a closer look at navigating new investment products, check out this guide to the best crypto exchange platforms: https://sportsixth.com/best-crypto-exchange/

In a parallel move, Bitcoin ETFs took a hit—shedding $278 million in outflows, prompted by a major price drop and headline-driven volatility involving US political and tech leaders. Bitcoin’s own 3% slip reinforced how volatile mainstream crypto tokens remain. Over recent weeks, BTC ETF flows have whipsawed between inflows and exits, confirming growing uncertainty among both institutional and retail investors. More insights on recent price swings and regulatory moves are available in this market analysis: https://sportsixth.com/crypto-markets-fed-nvidia-volatility/

Corporates and asset managers remain focused on Ether. BlackRock recently grew its exposure with a $50 million on-chain ETH buy, strengthening the case for institutional faith in the asset. While market sentiment wavers, the Ethereum ecosystem has drawn optimism from recent statements by its co-founders, who anticipate sharp technological improvements—including a tenfold scaling boost on the mainnet over the next year.

Expert take: Institutional flows often lead broader market trends, especially in emerging digital asset markets. “ETF activity is a powerful signal,” says one analyst, “and consistent inflows—even during market drawdowns—highlight institutional conviction and long-term thesis for blockchain-based assets.”

For those tracking Ethereum’s long-term development, staying updated on ongoing upgrades and potential risks is crucial. Deep dive into the upcoming Pectra update and security considerations for the ETH network: https://sportsixth.com/ethereum-upgrades-pectra-fusaka-eth-value-concerns/

In summary, the resilience of Ethereum ETF inflows—even as ETH’s spot price stumbles—underscores a shifting narrative in crypto investing. Institutional conviction via exchange-traded funds may be setting the stage for ETH’s next act, all while fueling broader interest in blockchain-based financial products.