Crypto Innovation: Bitcoin Fund Debuts with Unique Gold Protection—What Investors Need to Know

In a significant move for the crypto investment landscape, Cantor Fitzgerald Asset Management is gearing up to launch the Gold Protected Bitcoin Fund, a new product that aims to redefine digital asset risk management. The main keyword, “crypto,” anchors this innovative offering in a growing trend of blending traditional finance with blockchain-based solutions.

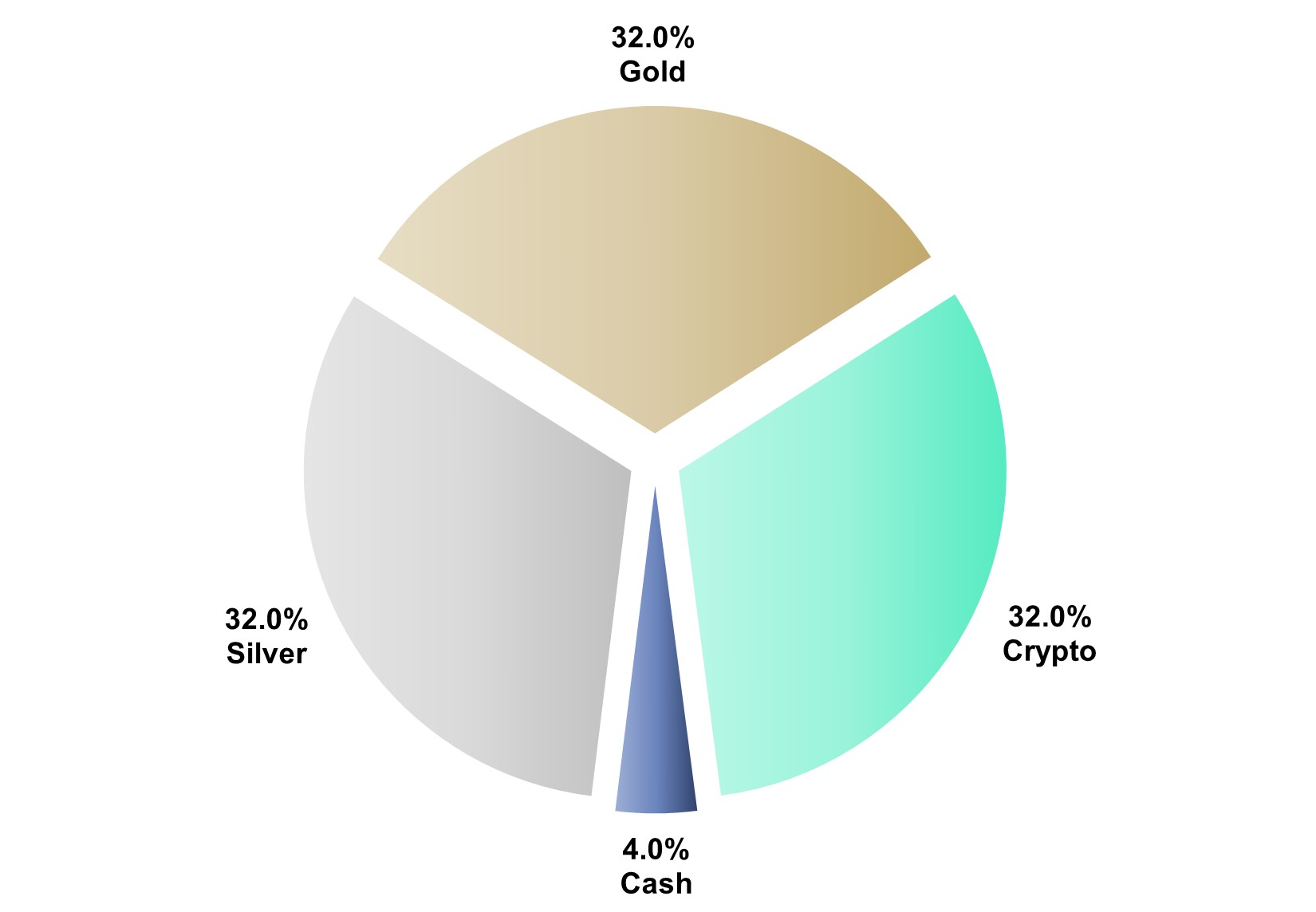

Launched as the firm’s inaugural Bitcoin-focused fund, the vehicle enables investors to capitalize fully on Bitcoin’s upside while enjoying unique downside risk protection. Over a five-year period, the fund ensures that any potential losses are cushioned by a 1-to-1 link to the price of gold. This strategic approach targets one of crypto’s most persistent challenges: extreme volatility.

You might also like: [Nasdaq up on Nvidia earnings, Dow Jones declines on tariff uncertainty]

A Strategic Hedge Combining Gold and Crypto Growth

This fund doesn’t just offer passive exposure to digital assets. By linking downside protection directly to the gold price, it provides a risk-mitigation layer historically cherished by institutional and retail investors alike. As Bitcoin matures and institutional adoption accelerates, such hybrid strategies are expected to gain traction. Industry experts note that these products could encourage more mainstream capital to participate in the DeFi and altcoin sectors, further bridging the gap between blockchain innovation and legacy financial instruments.

Cantor Fitzgerald has already demonstrated a deep commitment to digital finance, recently collaborating with Tether, Bitfinex, and SoftBank to establish 21 Capital—a $3 billion Bitcoin-focused venture. Such moves underscore the firm’s strategic vision to capitalize on shifts in U.S. crypto policy and foster a robust environment for both established and emerging assets.

For investors seeking the best crypto wallet solutions or guidance on choosing a secure cryptocurrency wallet, the fund’s protective approach is particularly appealing. It aligns with ongoing trends in portfolio diversification, where blending crypto and gold is increasingly viewed as a smart defense against market swings.

Market Timing and Expert Perspective

Chairman Brandon G. Lutnick highlighted the forward-thinking nature of the product, emphasizing Cantor’s focus on digital asset innovation and client-centric solutions. The fund’s soft launch is set for the coming weeks, signaling a timely entry amid evolving market dynamics. As global regulators sharpen their approach to crypto compliance, investor interest in risk-managed vehicles is on the rise. You can learn more about such developments in our deep dive on crypto regulation trends.

What makes this particular fund notable is its use of gold—a globally recognized safe haven—as a direct hedge. According to industry analysts, this could inspire fresh institutional inflows and may set the standard for a new generation of crypto funds that address volatility concerns without sacrificing potential gains.

Want to explore more about safe and effective crypto strategies? Visit our expert guide on cryptocurrency trading for beginners.

You might also like: [US government sanctions Philippines firm over massive crypto scam infrastructure]

—