Crypto’s $4 Trillion Real Estate Play: Deloitte Forecasts Massive Tokenization Growth

A landmark forecast from global consulting firm Deloitte suggests that blockchain technology is poised to significantly reshape real estate investment through asset tokenization.

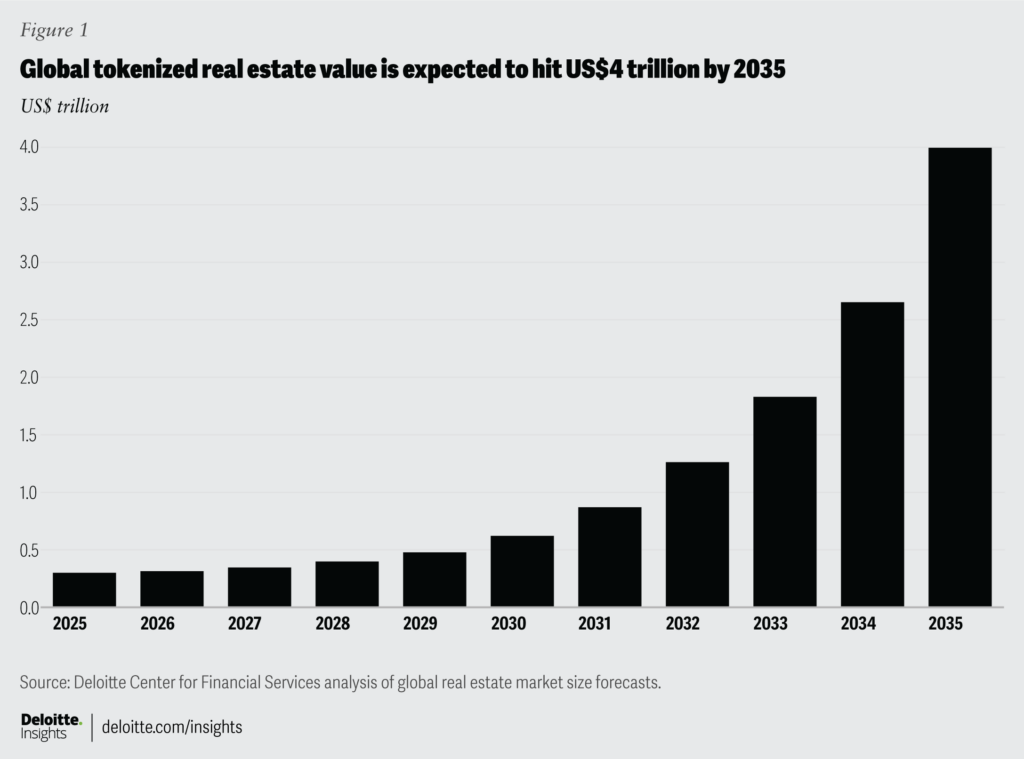

In its recent FSI Predictions 2025 report, Deloitte projects the market for tokenized real estate could surge to an astounding $4 trillion by 2035. This represents a substantial 27% compound annual growth rate from the estimated $300 billion market value in 2024. The analysis points towards real-world asset tokenization as a key crypto trend.

Projected growth of tokenized real estate value by 2035 | Source: Deloitte

A significant portion of this growth, potentially $1 trillion, is expected within tokenized private real estate funds. Traditionally, access to such funds has been restricted to accredited investors. However, tokenization promises to democratize access, potentially opening these opportunities to a broader range of global and retail participants.

Under this model, investors hold crypto tokens representing their stake in a fund, or even specific properties within its portfolio. These digital assets could offer enhanced liquidity, making it simpler for investors to enter and exit positions compared to traditional real estate investments.

Deloitte anticipates another major segment, tokenized loans within securitization (similar to mortgage-backed securities), could reach $2.39 trillion by 2035. This would capture approximately 0.55% of the total market. Tokenization here could offer benefits like real-time payment tracking, reduced operational costs, and improved transparency.

The report highlights key advantages offered by blockchain technology in real estate. It can drastically cut administrative overheads, a significant cost factor in the current system, while simultaneously expanding the investor base.

Despite the optimistic outlook, Deloitte acknowledges hurdles the industry must overcome. Key concerns revolve around secure custody solutions for digital assets, evolving accounting standards for tokenized holdings, and clear protocols for handling defaults. Furthermore, cybersecurity remains a critical challenge for this nascent market.