Bitcoin Price Shows Strength, But Why Are Big Players Holding Back?

Bitcoin (BTC) has recently displayed encouraging technical signals, suggesting potential upward momentum, yet persistently low trading volume indicates widespread caution among major market participants.

The leading cryptocurrency achieved a significant technical milestone on April 18th, closing decisively above its 50-day simple moving average (SMA) with a strong daily candle. Although the price adjusted slightly to $84,349, it remained above the crucial 50-day SMA support level, then situated at $84,202.

This marked the first convincing close above this key average since early February, hinting at a possible positive shift after months of consolidation. However, the picture isn’t entirely clear. While holding above the 50-day SMA, Bitcoin is still struggling beneath the 50-day exponential moving average (EMA), currently positioned at $85,328. This level has proven challenging, with several breakthroughs in the past week failing to sustain.

Adding to the uncertainty is the notably low trading activity. This suggests that despite the positive chart pattern, buyers remain hesitant to commit significant capital. Understanding market movements requires familiarity with concepts like moving averages, often covered in guides for cryptocurrency trading for beginners.

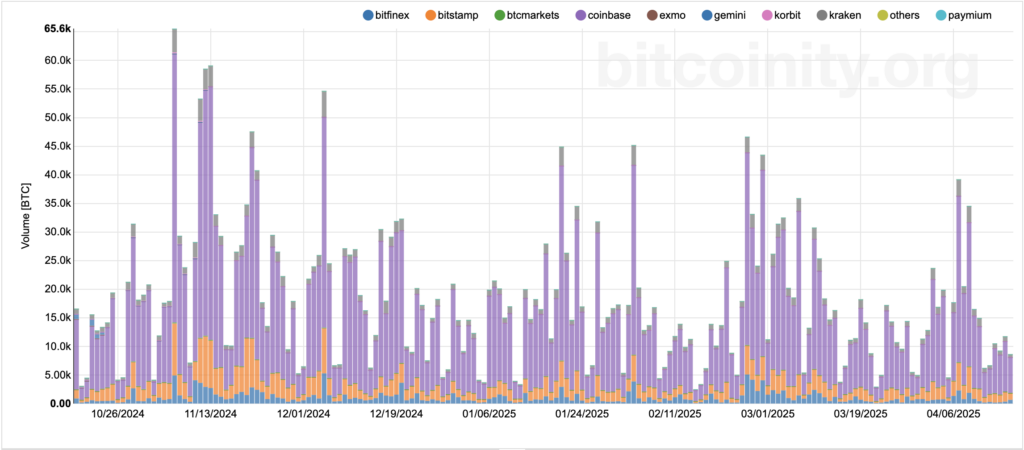

Data from major exchanges highlights this concern. On April 17, daily trading volume registered approximately 8,000 BTC. This figure represents a sharp decline compared to earlier in the month, such as April 9, when volume reached around 26,000 BTC.

This lack of conviction likely stems from broader market anxieties. Investors seem to be awaiting favorable macroeconomic developments, which have been scarce. Ongoing global trade tensions fuel fears of an economic slowdown, while central banks proceed cautiously with monetary support, wary of inflationary pressures from tariffs.

Looking ahead, Bitcoin faces immediate resistance near the $85,000 mark. This price point aligns with a descending channel pattern established since its January peak. If trading volumes do not pick up, the asset could risk declining towards the channel’s midpoint, estimated around $75,000. The interplay between technical levels and macro fears continues to rattle crypto markets.