Crypto Market Alert: Bitcoin at $108K Triggers $211M Liquidation—Will the Slide Continue?

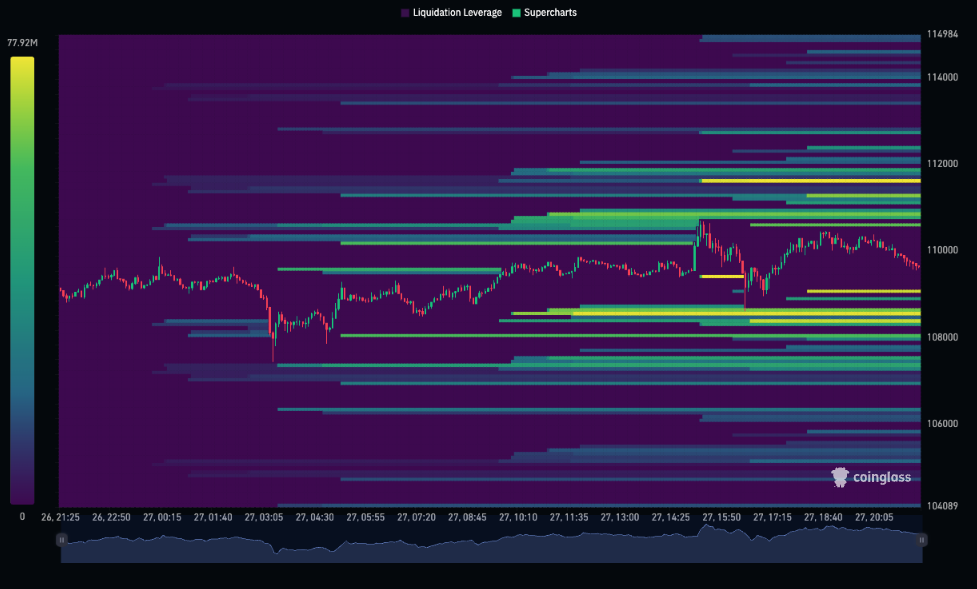

Crypto markets are flashing red as Bitcoin tests the crucial $108,000 support level, raising alarms about potential liquidations and what might come next. On May 27, the Bitcoin (BTC) price volatility led to $211 million in liquidations across the broader crypto landscape, with $131 million wiped from long bets alone. This pronounced imbalance suggests many traders were caught off-guard by BTC’s tumble, putting market stability in question as the leading crypto asset sits at a key technical area.

Experts monitoring blockchain and trading data point out that the $108,000 zone has become a liquidity magnet—where both bulls and bears battle for control, shaping short-term sentiment. Analysts emphasize caution: aggressive long positions near this level could face further losses if Bitcoin breaks down below the support range. They advise traders to monitor resistance at $110,800–$112,000 before making substantial moves or re-entering with leverage, as price rejection here may invite more volatility.

You might also like: EOS surges as key altcoin breakout signals bullish momentum

Binance BTC/USDT liquidation heat map | Source: Coinglass

From a broader perspective, the heavy cluster of liquidations near $108,000 highlights just how important this level is in the crypto ecosystem. If Bitcoin drops beneath this floor, experts warn that we could see a new round of liquidations—potentially forcing a rapid cascade lower if liquidity providers and capital inflows don’t absorb the losses. This underlines the importance of strict risk controls, especially for traders using margin and derivatives.

For those seeking a more thorough education on risk and trading, our guide on cryptocurrency trading for beginners offers strategic insights to navigate turbulent markets.

Despite short-term caution, top market analysts remain bullish about Bitcoin’s fundamentals. Recent research from leading blockchain institutions shows that institutional demand is outpacing freshly minted supply—meaning more buyers are stepping up as new Bitcoins are mined. This dynamic could support higher prices and reduce downside risk in the long run, particularly as investors diversify into alternative crypto tokens and decentralized finance (DeFi) products.

Read more: Bitcoin holds $84K amid market rout and tariff volatility

In summary, Bitcoin’s $108,000 level has become a pivotal point for the entire crypto market. Traders are urged to approach with care, deploying capital only when key technical thresholds are respected. But with institutional interest heating up and demand now outpacing supply, the long-term outlook could be increasingly favorable for those with disciplined strategies.