AI: What to Watch in Nvidia’s Earnings Beyond Export Restrictions

As Nvidia prepares to disclose its earnings for the first quarter of fiscal year 2026, market observers are keen to analyze not only the effects of U.S. chip export laws but also other pivotal developments worth noting. Like a seasoned analyst, Kevin Cook from Zacks Investment Research emphasizes that the company’s recent introduction of the GB200 NVL72 exascale system should be at the forefront of investors’ radar.

This innovative GB200 NVL72 system, which comprises 72 GPUs and carries a hefty price tag exceeding $3 million, started shipping in February. With expectations high and demand surging, the recent upheaval stemming from developments related to DeepSeek has led many analysts to drastically reduce their delivery projections for the system.

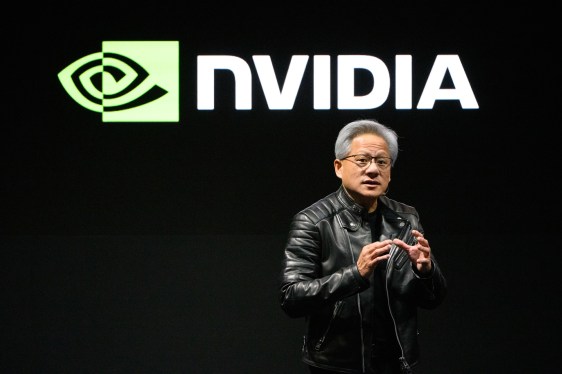

Cook indicates that since Nvidia is only beginning to ship these new machines, the imminent earnings report will play a critical role in shaping future projections. “If Jensen Huang announces deliveries of 10,000 units for Q2, it will certainly impress the market — that could translate to $30 billion in revenue for this innovative product. However, I suspect they might only deliver around 5,000 units,” he remarked, underlining the moment’s significance.

This situation raises questions about whether businesses will consistently upgrade their AI systems akin to how consumers routinely replace their smartphones. Cook remains uncertain about this trend but recognizes its potential to affect Nvidia significantly in the long run.

While Nvidia’s stock may react immediately to any updates about U.S. export controls, Cook argues that the long-term valuation is more closely tied to demand for the GB200 NVL72. After a sudden drop in Nvidia’s share price triggered by export restrictions, the stock rebounded swiftly, illustrating its resilience in a volatile market.

“We witnessed a sudden crash, but the stock quickly bounced back,” Cook noted, reaffirming Nvidia’s unique position within the tech industry. “Many firms might struggle, but Nvidia has a robust moat protecting it against challenges. Ironically, amidst concerns over China and sales capabilities, the company continues to find substantial customer interest around the globe.”

Despite potential tightening on exports to China, Nvidia’s ongoing partnerships with major hyperscalers are unlikely to falter. The recent news surrounding Stargate’s new project in the Middle East also presents promising opportunities for growth.

In conclusion, Cook underscores that insights from Nvidia’s shipping forecasts for the GB200 NVL72 will be the critical takeaways from this earnings report. “As long as we see steady to exceptional delivery expectations, any fluctuations in this quarter’s revenue will likely be regarded as secondary. The momentum now favors Nvidia for a successful year ahead,” he said.