Crypto Market Buzz: IOST Price Jumps 12% as $21 Million Funding Fuels Real-World Asset Expansion

Crypto markets are stirring after IOST, a leading multi-chain blockchain project focused on real-world asset (RWA) infrastructure, saw its native token surge 12% as news broke of a $21 million strategic investment. This funding round drew support from major venture capital players and is set to ramp up the platform’s efforts in bridging traditional finance with decentralized finance (DeFi) for global adoption.

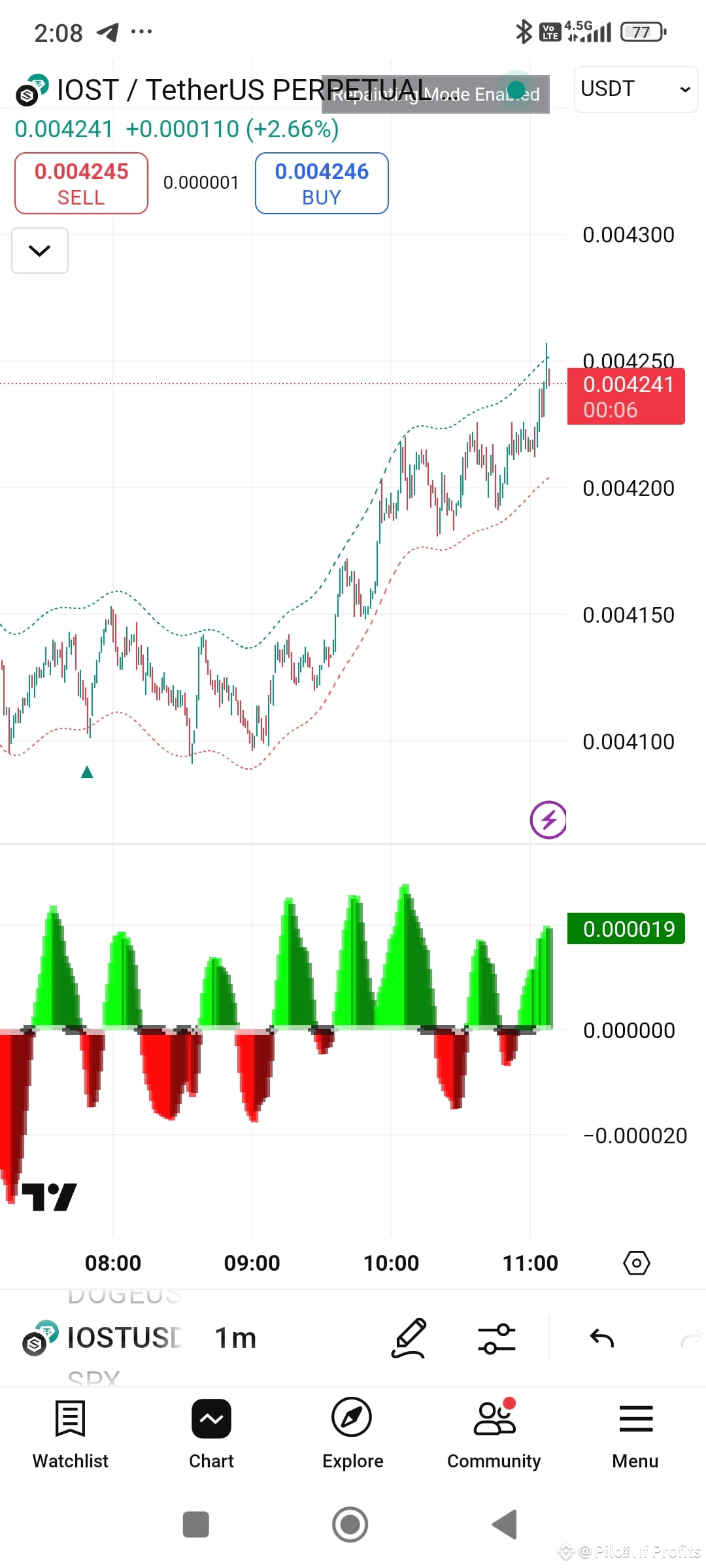

Early on June 6, IOST’s token price climbed to $0.00424—marking its highest value since late May and breaking a persistent downtrend. This uptick was matched by a dramatic leap in trading volume, which soared over 760% to exceed $74 million in 24 hours. Open interest similarly ballooned by 92% to surpass $15 million, signaling robust participation from crypto traders at a time when most altcoins were seeking to recover from recent market turbulence triggered by macro headlines and industry power-shifts.

What stands out about this momentum? Industry observers note that the IOST blockchain team is now at the heart of DeFi’s next phase: turning real-world financial instruments into on-chain assets. Following its $21 million raise, which gathered heavyweight backers such as DWF Labs, Presto, and Rollman Management, IOST is accelerating efforts to expand interoperability and accessibility across the RWA ecosystem.

An IOST team spokesperson shared, “This capital will drive exciting product launches and deeper ecosystem integration, cementing IOST’s leadership in the push for RWA 3.0 innovation.”

Recent partnerships underscore this ambition. IOST has teamed up with AWE, a pioneering AI agent platform for autonomous worlds, to incorporate a groundbreaking 5A framework. This platform transforms AI agents into yield-generating, blockchain-based assets, further cementing the convergence of AI and decentralized finance.

Additionally, collaboration with Matrixdock opens the door for IOST users to access tokenized U.S. Treasury bills and gold—reflecting a broader industry move toward tokenizing traditional asset classes. As regulatory and institutional acceptance advances, such projects position themselves as key contributors to the expanding universe of asset-backed crypto tokens.

Looking ahead, analysts expect continued attention on IOST as it capitalizes on the heated race to digitize real-world assets. Interested in learning more about market fundamentals during periods of high volatility? Check out our deep dive on how cryptocurrency trading works for beginners: cryptocurrency trading for beginners. For a closer look at RWA innovation, read about the latest asset tokenization trends: crypto-asset tokenization market forecast.