Crypto Markets React as U.S. Jobs Data Keeps Fed Rate Cuts in Question: What’s Next for Bitcoin?

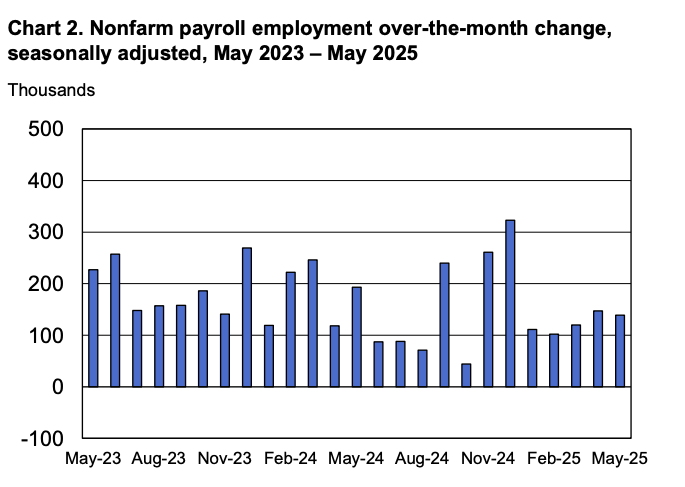

Crypto traders worldwide tuned in as the latest U.S. jobs report landed right on target for expectations, shaping speculation on when the Federal Reserve might adjust its next move. The headline figure for May—139,000 new jobs—was modestly above analyst forecasts, yet lower than the 147,000 jobs added in April. These employment numbers fueled debate on whether the crypto market could expect renewed momentum or further caution ahead.

With the unemployment rate holding steady at 4.2%, economists noted this is still historically low. In particular, the private sector outperformed, offsetting a drop of 22,000 jobs in government employment. While these details offered little direct bullishness for Bitcoin (BTC) or other top crypto tokens, analysts point out they were not enough to spark the recent decrease in digital asset prices.

Instead, macro drivers have set the tone—a high-profile political rift between former President Trump and billionaire Elon Musk dominated headlines, overtaking monetary statistics as the catalyst for crypto trends this week. Still, changes in labor and inflation data remain critical for Bitcoin investors as they weigh potential market shifts.

Why Job Numbers Matter for the Crypto Market

Interest rate expectations are a major touchstone for the crypto ecosystem. According to blockchain sector experts, job data is central to how the Fed frames its rate policy—which in turn affects everything from Bitcoin spot ETFs to DeFi liquidity inflows. With U.S. employment holding strong, policymakers have less incentive to lower rates aggressively, and the dollar remains supported for now.

However, the larger backdrop remains uncertain. The Fed is emphasizing inflation risks, especially with the added uncertainty posed by ongoing trade policy debates. In this scenario, persistently high rates can pressure crypto asset values—yet if inflation slows and rate cuts arrive, Bitcoin markets could see new inflows.

Bitcoin’s Outlook Amid Fed Uncertainty

For now, the market is bracing for possible reversals. Crypto traders—especially those tracking institutional Bitcoin strategies—are watching both the Fed and macroeconomic releases closely. Notably, as historical patterns show, sudden policy shifts can create high volatility and open up alternative investment opportunities across blockchain networks and altcoins.

Want to deepen your crypto knowledge? Read up on how economic volatility shakes the digital asset sector on our crypto market volatility guide. And if you want to understand how interest rates impact your staking and passive income strategies, visit our detailed crypto staking explainer.

Bottom line: With job numbers holding steady and no immediate move from the Fed, Bitcoin holders are wise to stay alert. The coming weeks will be critical for rate policy, inflation data, and ultimately, crypto price direction.