Crypto Treasury Surge: Ex-Ripple Leader Bets Big on Bitcoin, Know Labs Stock to Gain 82% BTC Exposure

Bitcoin’s growing appeal as a corporate treasury asset is making waves, and another major player is stepping up. Former Ripple chief risk officer Greg Kidd, a well-known crypto entrepreneur, is set to acquire Know Labs Inc.—a U.S.-listed medical technology innovator—and implement a bold Bitcoin treasury strategy.

The crypto sector has seen a surge of public companies allocating digital assets to their balance sheets, echoing the strategy made famous by Michael Saylor and MicroStrategy. Now, Know Labs will soon join that exclusive list. The company announced that Goldeneye 1995 LLC, tied to Greg Kidd, has signed to buy a controlling stake, paving the way for Kidd to become both CEO and chairman.

Unlike many traditional acquisitions, a significant portion of the $128 million deal will be paid in Bitcoin. Once finalized, Know Labs intends to hold 1,000 BTC—a sizable $105 million at current prices—making Bitcoin 82% of its market cap.

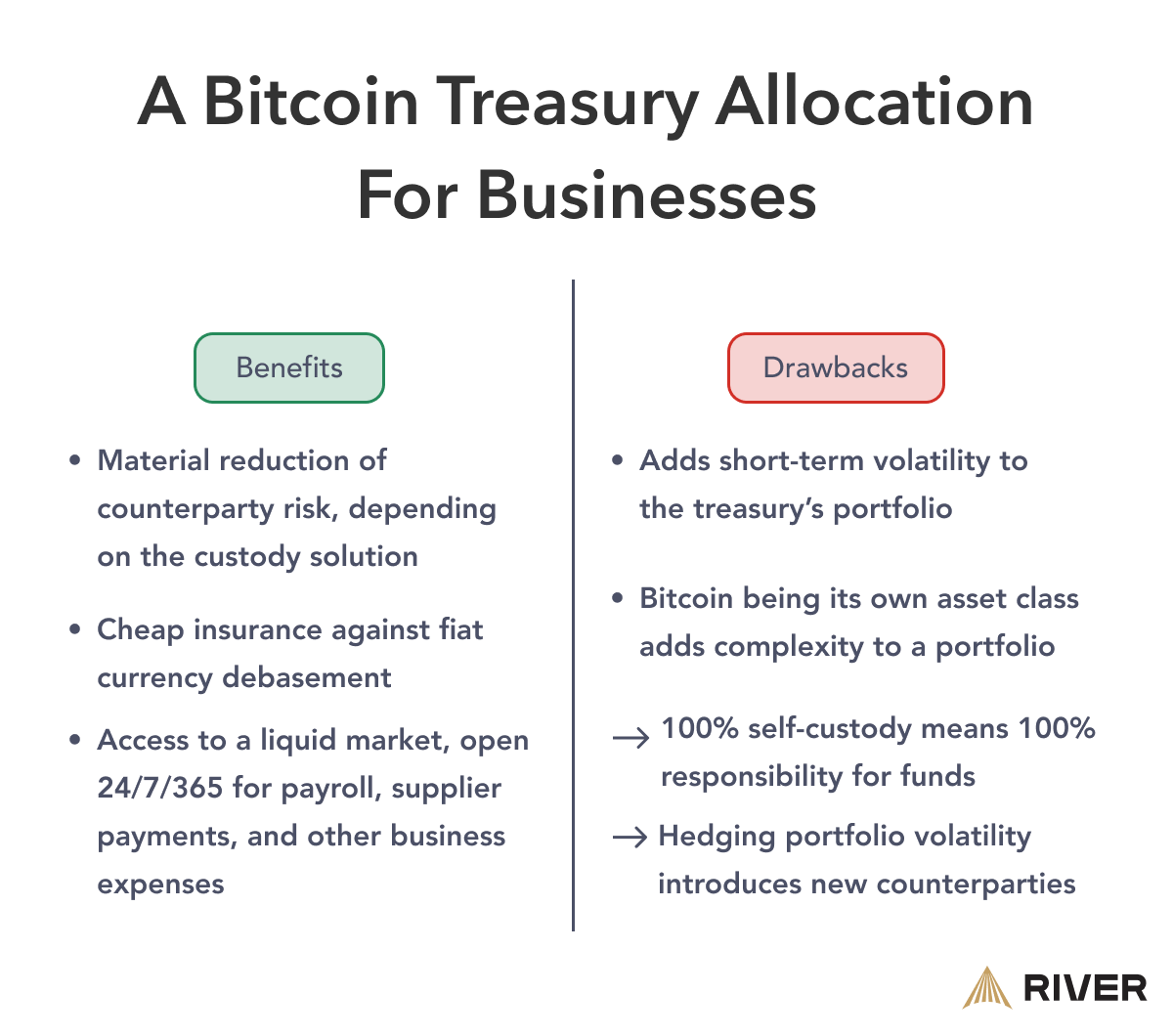

For investors, this move means substantial economic exposure to the world’s largest digital asset, a trend increasingly favored for both growth and inflation protection. As the blockchain industry matures, such treasury strategies are being watched closely by institutional players and shareholders alike.

Expert Context: Kidd’s track record extends well beyond Ripple. As co-founder of venture fund Hard Yaka, he’s backed leading crypto and technology firms like Coinbase, Solana, and Robinhood. His decision to adopt Bitcoin as a core asset comes as more corporate leaders seek resilient alternatives to fiat reserves amidst volatile macro and regulatory conditions. Notably, Know Labs’ planned net asset value multiple of 1.22x echoes the balance sheet strength that’s made other crypto pioneers stand out (see similar case studies).

“I’m thrilled to implement a Bitcoin treasury strategy with the support of a progressive medical technology company, especially at a time when both market and regulatory climates are highly favorable,” said Kidd. His move resonates with wider corporate moves in crypto, such as major filing and treasury shifts from listed firms (compare this with recent high-profile Bitcoin treasury moves).

The deal, set to close by Q3 2025 pending regulatory and shareholder approvals, signals a growing acceptance of Bitcoin in traditional sectors. For those learning how digital assets reshape business, Know Labs’ journey may set a template for others. For a deeper dive on strategic crypto allocation, read our guide on cryptocurrency trading for beginners.

As Bitcoin continues to win corporate converts, high-profile treasury shifts like this one reinforce its role as more than just a speculative asset—but as a pillar in modern portfolio strategies.