Crypto Stablecoins Set to Transform Global Payments: Why Uber and Big Tech Are Paying Attention

Crypto stablecoins are emerging as a game-changer for global payments, drawing attention from industry giants like Uber. At the recent Bloomberg Tech Summit in San Francisco, Uber’s CEO Dara Khosrowshahi announced the company is actively evaluating stablecoins—digital assets pegged to traditional fiat currencies—to streamline international transactions and cut cross-border costs. This move signals a growing recognition of stablecoins’ potential beyond investment: they’re quickly becoming essential infrastructure for modern finance.

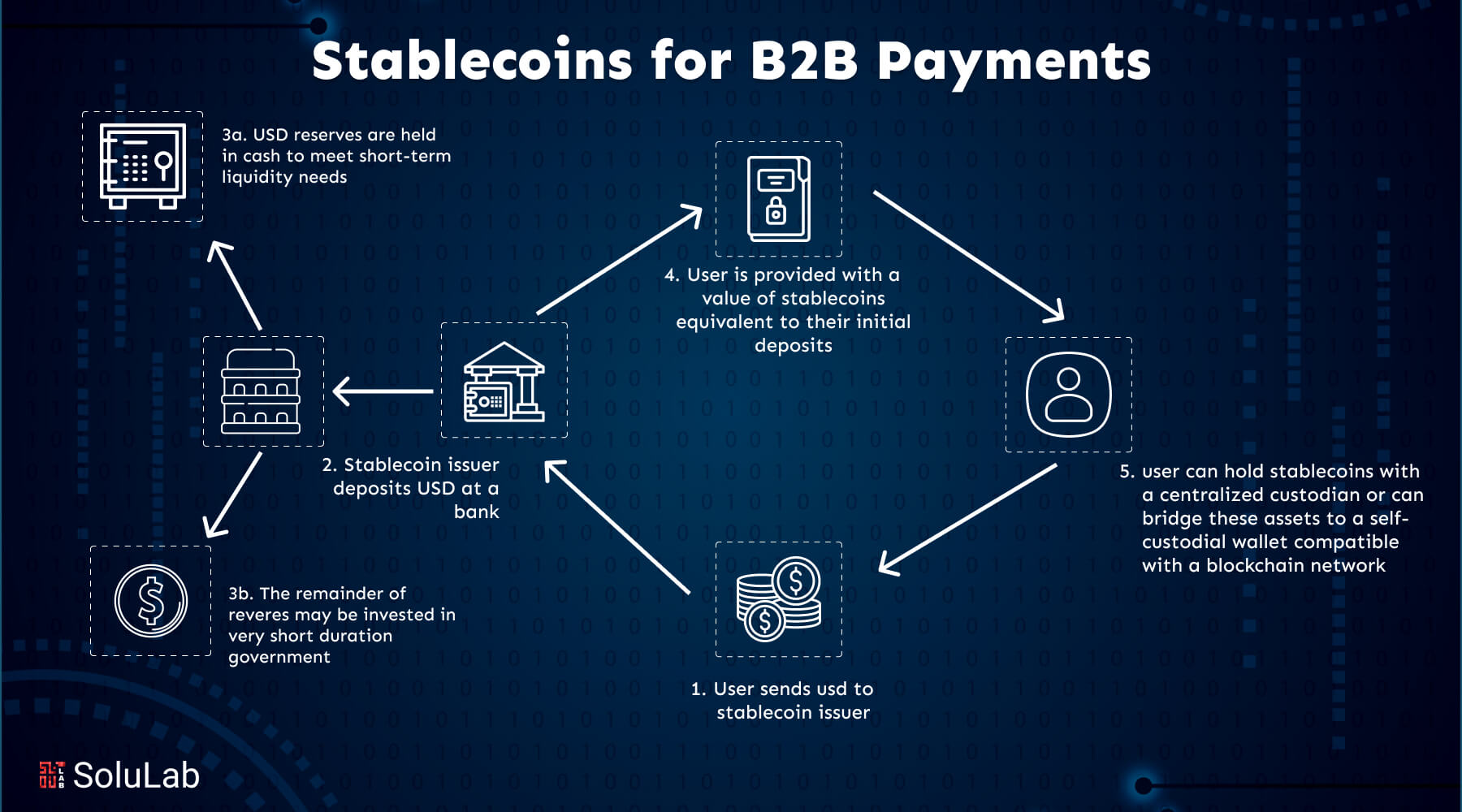

By leveraging blockchain technology, stablecoins provide fast settlement, minimal transaction fees, and global reach—qualities that appeal to multinational companies handling significant cross-border flows. While volatile cryptocurrencies like Bitcoin spark debate, stablecoins stand out for their payment utility, offering the confidence of fiat currencies combined with the speed of crypto tokens.

Financial institutions are taking notice too. A recent industry survey found that 90% of major banks, payment processors, and fintech platforms are already integrating stablecoins for routine operations. Nearly half of surveyed executives cited transaction speed as the top advantage, closely followed by cost savings and real-time liquidity—key features in today’s digital commerce landscape.

You may also find value in exploring how wallets are evolving in this space. Learn more about the best crypto wallets to secure your digital assets: best crypto wallet.

The uptick in enterprise adoption reflects a broader regulatory shift. Policymakers in the US and abroad are moving toward comprehensive frameworks supporting stablecoin innovation. In the United States, bipartisan legislation aims to clarify the requirements for payment stablecoin issuers, while Europe’s MiCA regulation sets new standards for digital asset compliance. Asian markets, including Hong Kong, Singapore, and Pakistan, are also rolling out robust oversight for stablecoins, further accelerating their mainstream acceptance.

Other tech giants aren’t far behind. Stripe’s co-founder John Collison recently revealed talks with banks about stablecoin integration, highlighting the momentum across the fintech sector.

For newcomers to the space, understanding the basics is crucial. Check out our beginner’s guide to cryptocurrency trading: cryptocurrency trading for beginners.

Experts predict the rise of stablecoins will power new forms of borderless finance and open up instant payments for customers and businesses alike. As robust regulatory frameworks emerge and traditional players increase adoption, the next wave of global fintech innovation is poised to run on crypto rails—proving that, when it comes to moving money across the world, stablecoins are no longer just an experiment, but a strategic necessity.