Solana dApps Outpace Entire Crypto Market, Generating Billions in Revenue: Why?

The ecosystem for decentralized applications (dApps) on the Solana blockchain is significantly outperforming competitors, generating substantial revenue.

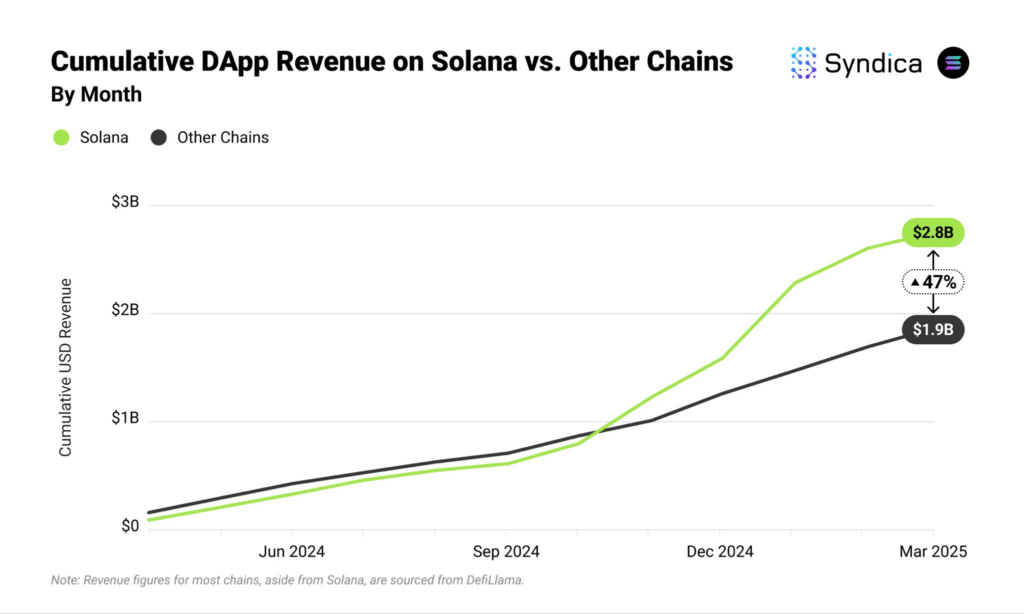

Recent industry reports highlight that Solana dApp revenue over the past 12 months reached an impressive $2.8 billion. This figure surpasses the combined dApp revenue from all other blockchain networks by 47%, indicating a strong preference for Solana’s platform.

Data reveals that Solana’s dApp earnings began to pull ahead of the collective competition back in October 2023. The gap has widened progressively since then, underscoring the network’s growing appeal to both developers and end-users.

Factors contributing to this trend include Solana’s characteristically low transaction fees and a focus on user experience, which attracts users. Simultaneously, developers are drawn to the blockchain’s accessible infrastructure and supportive environment.

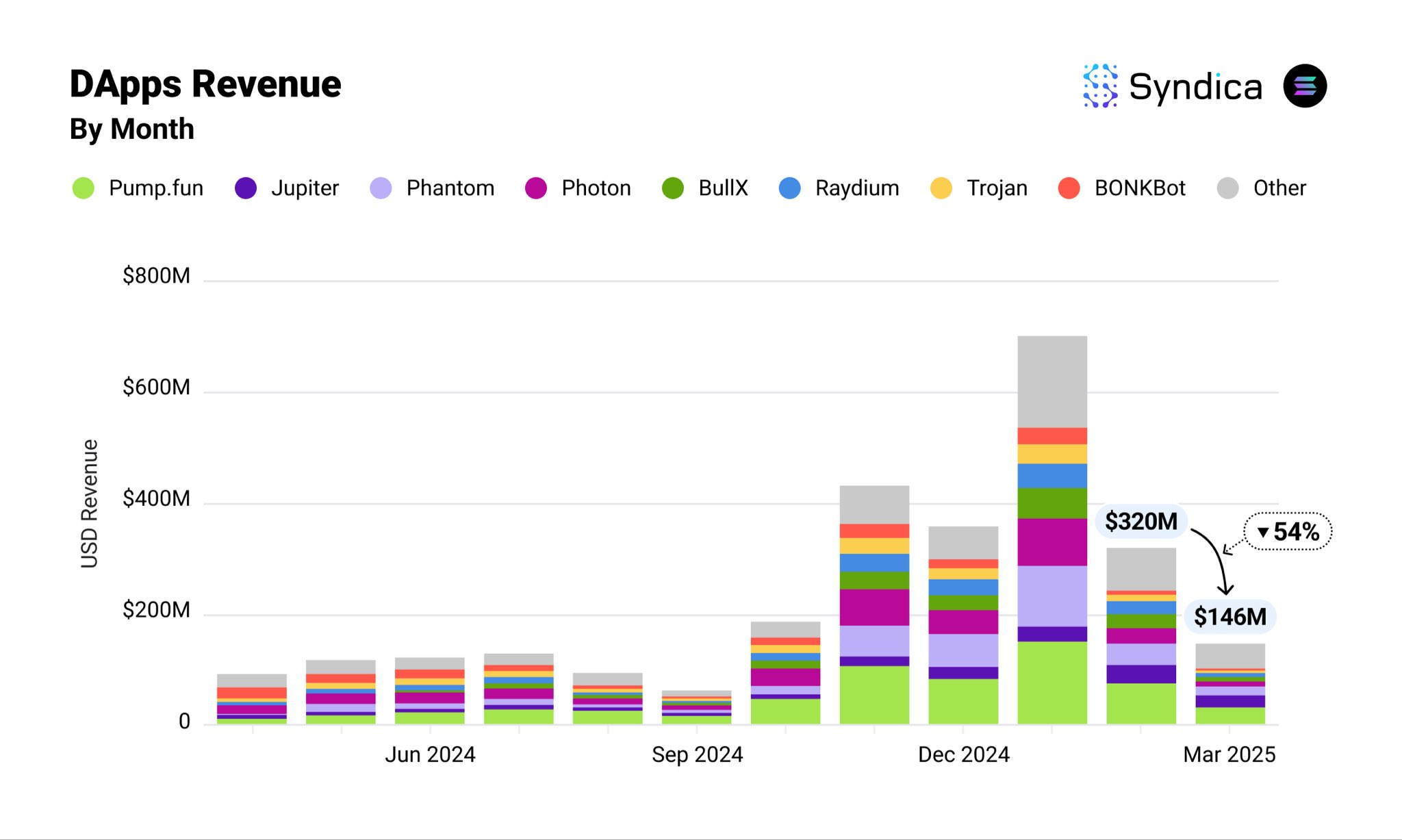

However, it’s important to note that a large portion of Solana’s dApp revenue stems from crypto trading applications, introducing significant volatility. Revenue experienced a sharp peak in January, hitting $701 million, coinciding with heightened market activity and elevated asset prices for tokens like SOL.

Following this peak, dApp revenue saw a considerable decline, falling to $146 million by March. This fluctuation emphasizes the close relationship between dApp earnings, high trading volumes, and the overall crypto market sentiment. Investors often track the Solana price steady above key support for market trends.

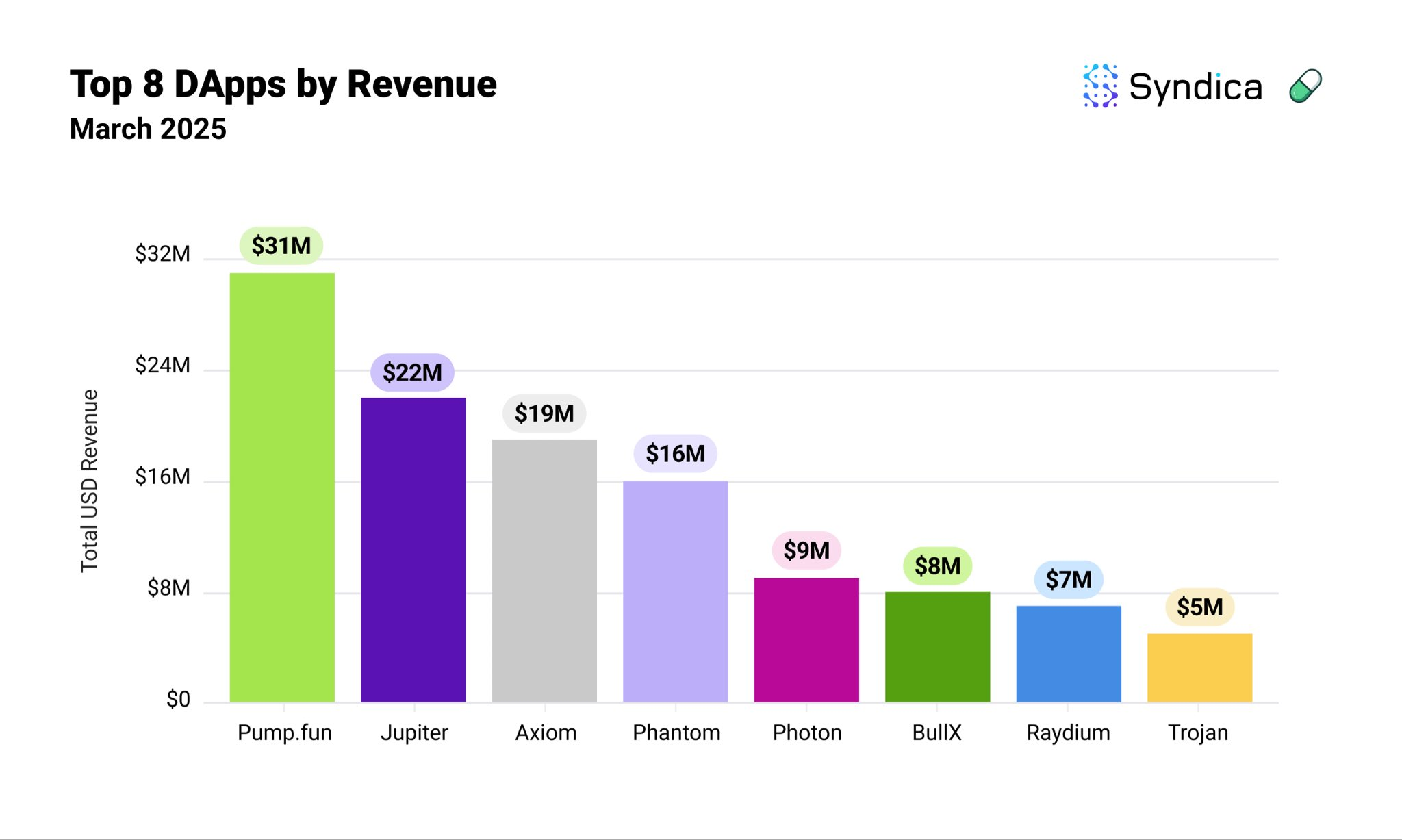

Pump.fun Leads March Earnings

Platforms centered around trading, including exchanges and wallets, dominate the list of top-earning dApps on Solana. Memecoin launchpad Pump.fun emerged as the highest earner in March, generating $31 million in revenue, outpacing established platforms like Jupiter and Phantom wallet.

Pump.fun now contends with growing competition from Axiom, another memecoin launchpad reportedly backed by Y Combinator. Axiom has rapidly gained market share, capturing 29% of the memecoin dApp segment and generating $19 million in revenue.

Meanwhile, within the What is DeFi? space on Solana, the decentralized exchange (DEX) Jupiter maintains its lead, accounting for 93% of the total DEX revenue on the network. Despite cooling market conditions in March, Jupiter delivered strong performance with $22 million in earnings, alongside consistent results from platforms like Kamino Finance.