Crypto Token SYRUP Spikes Over 35%: What’s Behind the Sudden Rally?

The SYRUP token saw a significant price increase, climbing as much as 36% in recent trading, spurred by notable ecosystem expansion and significant accumulation by large holders (‘whales’).

On April 17, the token associated with Maple Finance reached an intraday peak of $0.15. This surge marked a more than 76% recovery from its monthly low. During this period, SYRUP’s market capitalization approached $128.8 million, while its daily trading volume soared by 157% to exceed $10.7 million.

A surge in activity within Maple’s derivatives market also fueled the interest, with open interest in SYRUP futures jumping 90% within 24 hours to hit $359.6k.

The upward momentum appears closely linked to the growing footprint of the Maple Finance platform. Its ecosystem recently surpassed $1 billion in total value locked (TVL), positioning it ahead of other players in the space like Ondo Finance and Clearpool.

Observers noted that Maple’s TVL is nearing half the size of BlackRock’s prominent $2.46 billion BUIDL fund, a significant tokenized U.S. Treasury product highlighting the growth in real-world asset tokenization.

Data indicates this expansion is largely fueled by institutional appetite for on-chain credit solutions, specifically through Maple’s syrupUSDC and lstBTC offerings. The syrupUSDC product provides stable DeFi yields via lending mechanisms, whereas lstBTC enables institutions to generate returns on their Bitcoin without transferring assets from custody.

Another key driver for SYRUP’s performance is its attractive 10% yield, substantially higher than yields from other major blockchain networks. For context, Ethereum staking typically offers between 2.15% and 3.34%, and Solana staking yields range from approximately 5.64% to 8.25%.

Furthermore, on-chain data reveals increased activity among large SYRUP holders. Information from Santiment indicated a rise in wallets holding between 10,000 and 100 million SYRUP tokens, suggesting that substantial investors anticipate further price appreciation.

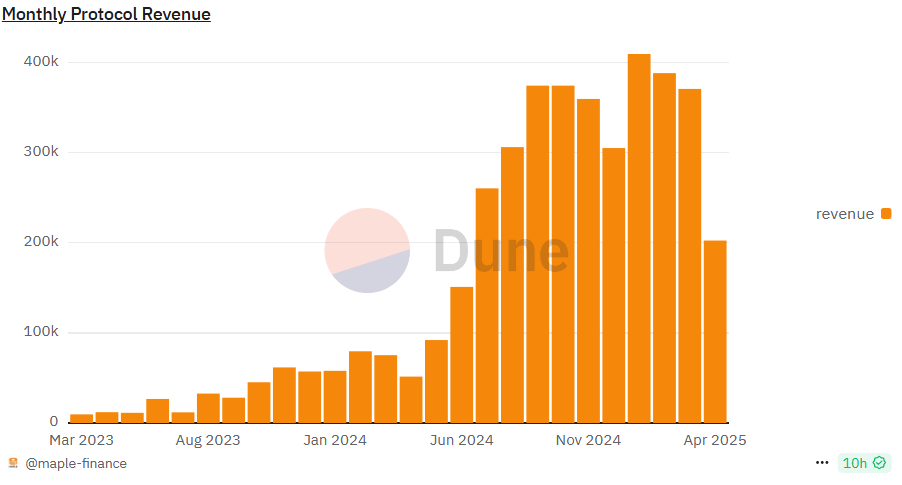

Maple’s platform revenue has also demonstrated healthy growth, climbing from around $150,000 last June to nearly $370,000 in the most recent month.

Institutional players are increasingly recognizing the project’s potential. Grayscale recently included Maple in its Top 20 crypto list, citing strong prospects for the upcoming quarter and boosting the project’s overall credibility.

SYRUP Technical Outlook

Current technical indicators suggest the rally may have more room to run.

The 4-hour SYRUP/USDT chart displays an inverse head and shoulders formation, often interpreted as a bullish signal by traders.

The Moving Average Convergence Divergence (MACD) indicator is trending upwards, signaling strengthening buyer momentum. Additionally, the Supertrend indicator has turned green, hinting at a potential shift towards a bullish market trend.

However, caution is warranted as the Relative Strength Index (RSI) has entered overbought territory. This often precedes a short-term price correction before a potential continuation of the uptrend.

Should the bullish momentum persist, the next significant resistance level lies near $0.191, representing the token’s March high and over 46% above current levels. Conversely, if the bullish pattern breaks down, SYRUP could retrace to the key support zone around $0.10. A failure to hold this level might trigger a more substantial decline towards the $0.085 mark.

Disclaimer: This content is for informational purposes only and should not be considered investment advice.