Bitcoin’s Reversal: Why Did Crypto Prices Tumble After Tariff News?

Optimism in the crypto market proved fleeting as Bitcoin led a sharp downturn, mirroring Wall Street’s retreat amid resurfacing economic anxieties.

The brief market reprieve triggered by a temporary pause in U.S. tariffs dissolved quickly. Major stock indices experienced significant declines on April 10; the S&P 500 dropped 4.31% to 5,233.61, the Dow Jones fell 3.23% to 39,296.45, and the Nasdaq Composite slid 4.66% to 16,333.49.

These losses effectively erased the gains from one of the S&P 500’s strongest daily rallies just the day before. While the tariff pause initially boosted sentiment, the focus shifted back to the persistent risk of a global recession, fueled by ongoing trade disputes, such as the significant U.S. tariffs remaining on Chinese goods.

Expert forecasts underscore this caution. Goldman Sachs estimates a 45% chance of a recession, while Moody’s chief economist, Mark Zandi, places the probability higher at 60%, highlighting the fragile economic backdrop despite short-term policy adjustments.

The risk-off sentiment spread decisively into the digital asset space. Bitcoin (BTC) saw its price fall back to $79,195.25 after briefly touching a high of $83,541. Ethereum (ETH) wasn’t spared, declining 5.38% to $1,506.76.

Other major cryptocurrencies also felt the pressure, with XRP losing 3.82% to trade at $1.94, and Solana (SOL) experiencing a 6.00% drop to $109.92, as investors shed exposure to more volatile assets.

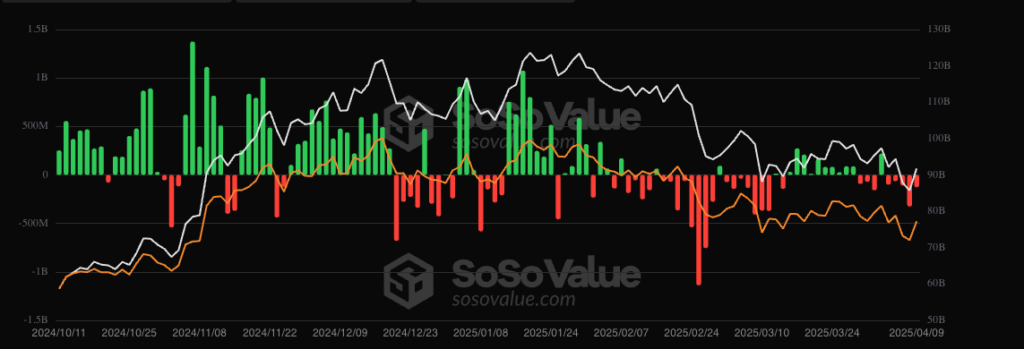

Further indicating cautious sentiment, Bitcoin exchange-traded funds (ETFs) continued to experience significant capital withdrawals. Following $326 million in net outflows on Tuesday, another $127 million exited these funds on Wednesday, April 9, despite the prior day’s market rally.

This trend suggests that institutional investors remain wary, prioritizing risk management over chasing short-term price bounces in the current economic climate.